Adobe Reader is required to view files in PDF format.

If you do not have Adobe Reader, click on the icon on the left and start downloading.

Corporate Governance

1. Basic Concept of Corporate Governance

The Nippon Kayaku Group recognizes that disclosing information to our shareholders and investors in a timely and fair manner, and ensuring the transparency of our management by reinforcing our check functions, are issues of great importance to realize the KAYAKU spirit, the corporate vision.

We believe that our management functions more effectively owing to the implementation of a corporate governance system that consists of consensus-based decision-making by the Board of Directors and an Audit & Supervisory Board Members system. We will also work to expand and reinforce corporate governance as a key management task in the future.

Corporate Governance Basic Policy Corporate Governance Report Skills Matrix

2. Corporate Governance System

Nippon Kayaku employs an audit & supervisory board members system. We have also introduced an “executive director system” to ensure our ability to quickly address changes in the business environment and carry out flexible operations. With this approach, we clearly separated our management “decision-making and supervisory functions” from our “operational execution functions,” strengthening each of them to ensure correct decision-making and rapid operations.

Board of Directors (convenes monthly)

To rapidly carry out management decision-making, we set the maximum number of Directors at ten(10), and are working to further strengthen our supervisory functions so that all decisions regarding important issues in our operations are made based on the rules and policies of the Board of Directors, in accordance with laws and the articles of incorporation. As of the date of submission, the Board of Directors is comprised of nine(9) Directors, of which three(3) are from outside of the company. With Atsuhiro Wakumoto, President and Representative Director, serving as the chair, the other members are Tomoo Shibuya, Hiroshi Mikami, Yoshitsugu Ishida, Kazuto Koizumi, Masatomi Akezuma, Yo Ota (Outside Director), Yasuyuki Fujishima (Outside Director) and Seiichi Fusamura (Outside Director).In addition, five(5) Audit & Supervisory Board Members (of which three(3) are from outside of the company) attend meetings of the Board of Directors. These members are Akihiro Kojima,Megumi Machida, Katsuji Higashi (Outside Audit & Supervisory Board Member), Yasuhiro Osaki (Outside Audit & Supervisory Board Member) and Ichiro Wakasa (Outside Audit & Supervisory Board Member). In addition, five (5) Audit & Supervisory Board Members attend these meetings and three (3) Executive Director with Official posts who do not concurrently serve as Directors attend these meetings as an observer.

Nomination & Remuneration Advisory Committee

The Nomination & Remuneration Advisory Committee is comprised of at least three(3) Directors (with the majority of these being those who are independent and from outside of the company) selected by the Board of Directors. The aim of this is to further enhance corporate governance by strengthening the fairness, transparency and objectivity of the procedures relating to the nomination and remuneration of Directors. This committee deliberates the selection and dismissal of Directors and Audit & Supervisory Board Members, the selection and dismissal of Representative Directors, the remuneration (e.g., the remuneration structure) of Directors and Audit & Supervisory Board Members, and other matters deemed necessary by the Board of Directors in response to inquiries from the Board of Directors. The committee then reports its findings to the Board of Directors.

Sustainable Management Meeting (convenes weekly)

This meeting discusses and receives reports concerning important items related to management and operations. After full discussion by the Sustainable Management Meeting members, these items are decided by the Executive President, who is the meeting chairman. As of the date of submission, the Sustainable Management Meeting is comprised of ten(10) executive officers. With Atsuhiro Wakumoto, Executive President, serving as the chair, the other members are Tomoo Shibuya, Yoshimi Inoue, Yoshitsugu Ishida, Masatomi Akezuma, Shigeyuki Kawamura, Hiroshi Shimada, Shinji Inoue, Makoto Takeda and Yasuhito Kato. In addition, Megumi Machida, Standing Audit & Supervisory Board Member, attends these meetings as an observer.

Executive Directors Meeting (convenes quarterly)

This meeting is chaired by the company president, and is composed of the Executive Directors (up to twenty-five(25)) who are in charge of the execution of operations, and who are appointed by the Board of Directors. At the meeting, Executive Directors report on the status of operational execution that are entrusted to them by the Board of Directors and the company president, as well as on other necessary items. As of the date of submission, the Executive Directors Meeting is comprised of twenty-eight(28) Executive Directors. With Atsuhiro Wakumoto, Executive President, serving as the chair, the other members are Tomoo Shibuya, Yoshimi Inoue, Yoshitsugu Ishida, Masatomi Akezuma, Shigeyuki Kawamura, Hiroshi Shimada, Shinji Inoue, Makoto Takeda, Yasuhito Kato, Tsutomu Kawamura, Kenichiro Yoshioka, Takumi Fujita, Hideyuki Yuya, Yoshinori Kato, Tadayuki Kiyoyanagi, Seiichiro Kodama, Yoshiki Akatani, Yuko Nagai, Atsurou Inubushi, Shigeru Maeda, Shigehide Kagaya, Masako Aono, Tsuyoshi Kuboyama, Atsuya Saimoto, Kazuhiko Ishii, Hajime Suetsugu and Shuichi Kobayashi. In addition, four (4) Outside Directors and five (5) Audit & Supervisory Board Members attend these meetings as an observer.

Management Strategy Meeting (convenes biannually)

The Nippon Kayaku Group business policies and business strategies decided by the Board of Directors, as well as other important items related to general management are communicated at this meeting to management personnel to ensure that everyone in the Group is well informed.

Audit & Supervisory Board (convenes monthly)

Based on its rules and policies, the Audit & Supervisory Board is comprised of five(5) Audit & Supervisory Board Members, of which three(3) come from outside of the company.

With Akihiro Kojima, Standing Audit & Supervisory Board Member, serving as the chair, the other members are Megumi Machida, Katsuji Higashi (Outside Audit & Supervisory Board Member), Yasuhiro Osaki (Outside Audit & Supervisory Board Member) and Ichiro Wakasa (Outside Audit & Supervisory Board Member).

Committees

Nippon Kayaku has established the following committees as part of the corporate governance system. Meetings are convened regularly and as necessary, and these committees maintain internal controls.

1. Ethics Committee (convenes biannually)

The committee chair is an executive director with an official post who has been appointed by the president. The committee consists of representatives from each corporate headquarters business group and division. The committee determines the policy and specific measures on compliance with the Nippon Kayaku Group Charter of Conduct and Code of Conduct. It consults on incidents, responds to incidents as they occur, and considers and determines what steps to take to prevent recurrence.

2. Crisis Management Committee (convenes biannually)

The committee chair is an executive director with an official post who has been appointed by the president. The committee consists of representatives from each corporate headquarters business group and division. This committee configures and manages the crisis management system to prevent risks that could inflict major damage on the corporate management and business activities of the Nippon Kayaku Group from materializing, and to respond to an emergency when one occurs and work to recover from the damage after the emergency has ended.

3. Audits

Internal Audit

Nippon Kayaku has established an Audit Division as an organization that reports directly to the president to contribute to strengthening corporate governance including preventing improper acts and errors, improving business practices, and protecting assets. The Audit Division implements business audits of all departments, including Japanese and overseas group companies, in accordance with the annual auditing plans that are approved at the Sustainable Management Meeting. The Audit Division immediately reports the outcome of its audits to the Representative Directors and Audit & Supervisory Board Members. The Audit Division is staffed by six (6) persons.

Audit & Supervisory Board Members and the Audit Division maintain an active line of communication, regularly exchanging information once every three months in an effort to improve the effectiveness and efficiency of information collection and auditing. Further, the Internal Control Management Division for areas in charge of compliance, risk management and J-SOX works with Audit & Supervisory Board Members to hold regular information exchange meetings once every three months and biannual J-SOX evaluation briefings.

Audit & Supervisory Board Members receive the audit plans formulated by the financial auditors at the beginning of the period; work to ensure communication of intent with the financial auditors by exchanging opinions during the period, being present for inventory at the end of the period, and other means; and receive reports on and explanations of quarterly reviews and the results of the audit of financial statements at the end of the fiscal year from the financial auditors.

Financial auditors, persons in charge of J-SOX-related matters at the Internal Control Management Division and the Audit Division collaborate by holding regular information exchanges.

As described above, Audit & Supervisory Board Members, financial auditors and the Internal Control Management Division form a three-pronged Audit Division that promotes mutual collaboration to improve the effectiveness and efficiency of audits.

Audit & Supervisory Board Members’ Audits

The Audit & Supervisory Board of Nippon Kayaku consists of five(5) Audit & Supervisory Board Members (two(2) of which are fulltime members and three(3) of which are outside members), with a standing auditor serving as the chair of the Audit & Supervisory Board.

Based on the audit policy, audit method, audit plan, and distribution of audit operations decided by the Audit & Supervisory Board at the beginning of the term, Audit & Supervisory Board Members exercise oversight by attending meetings of the Board of Directors and other important meetings, reading important documents, conducting audits of the status of operational execution, and taking other steps to monitor and supervise the performance of Directors’ duties from an independent standpoint.

Full-time members of the Audit & Supervisory Board conduct audits on the business conditions of the Company and the execution of duties by Directors and Executive Directors by attending Management Meetings and other important meetings, performing visiting audits of major departments, business locations and Group subsidiaries, conducting interviews, and viewing meeting minutes and other important materials. In addition to attending meetings of the Audit & Supervisory Board and receiving reports on the status of the abovementioned audits, outside members of the Audit & Supervisory Board express their opinions, where needed, when attending visiting audits, and by providing advisory opinions at information exchange meetings held with the Internal Control Management Division for areas in charge of compliance, risk management and J-SOX.

Financial Audits

The Audit & Supervisory Board of Nippon Kayaku evaluates financial auditors and determines the appropriateness of their reappointment based on the “policy on decisions concerning the dismissal or refusal to reappoint financial auditors” and the “guidelines for the evaluation and selection of financial auditors” prescribed by the Audit & Supervisory Board. As a result, a decision was made to reappoint the services of Ernst & Young ShinNihon LLC as financial auditor.

4. Outside Directors and Outside Audit & Supervisory Board Members

Nippon Kayaku has established independence standards for electing Outside Directors and Outside Audit & Supervisory Board Members, and determines the independence of Directors and Audit & Supervisory Board Members.

Outside Directors

Nippon Kayaku elects three(3) Outside Directors to improve management transparency and reinforce the corporate governance system. They are reported to the Tokyo Stock Exchange as Independent Directors.

Outside Directors attend Board of Directors Meetings and other important meetings and provide opinions when appropriate. They also supervise our company’s management.

Outside Audit & Supervisory Board Members

Nippon Kayaku elects five(5) Audit & Supervisory Board Members in total, three(3) of which are Outside Audit & Supervisory Board Members. Two(2) of the Outside Audit & Supervisory Board Members are reported to the Tokyo Stock Exchange as an Independent Officer.

Outside Audit & Supervisory Board Members attend Board of Directors Meetings and other important meetings and provide opinions when appropriate. They also attend Management Strategy Meetings (convened biannually) to develop a grasp of and understand the overall state of management, including the management policy of the Company. The full-time Audit and Supervisory Board Members also give summary explanations of the content of the Management Meeting, the results from onsite audits, and other matters to Outside Audit & Supervisory Board Members as needed.

Each of the Audit & Supervisory Board Members conduct audits from an independent standpoint through the above actions, and we have determined the system to function sufficiently in terms of the management oversight functions.

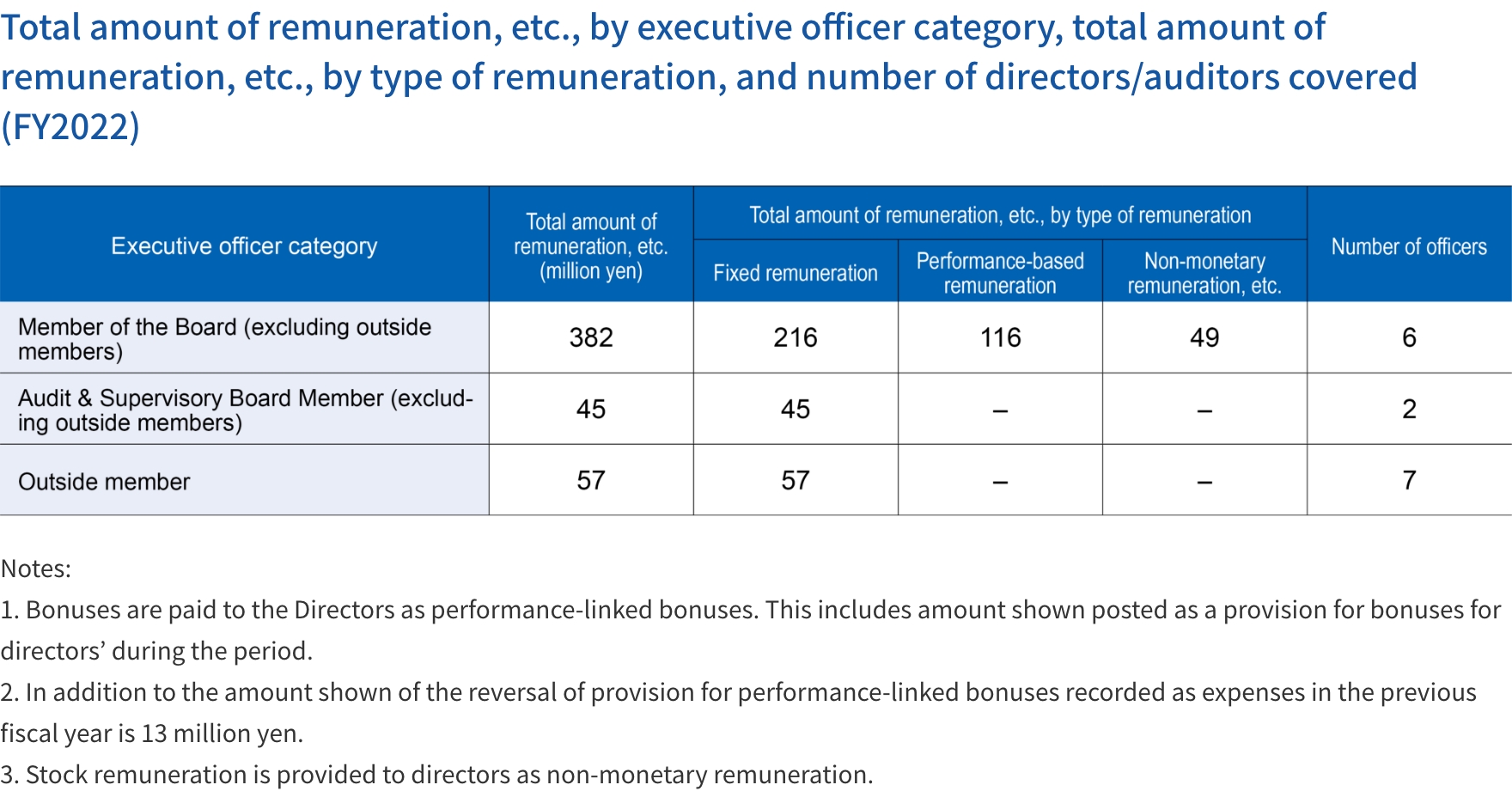

5. Remuneration to Directors and Audit & Supervisory Board Members

At the 149th Annual Shareholders Meeting held August 30, 2006, Nippon Kayaku passed a resolution setting the remuneration(The present basic remuneration) limit for Directors to 360 million yen, with the annual limit on bonuses(The present performance-linked bonuses) set to 200 million yen.

At the 164th Ordinary General Meeting of Shareholders held on June 25, 2021, we also passed a resolution that the total amount of the monetary remuneration credits to be paid as compensation about Restricted Stock for the Directors (excluding outside directors) shall be 100 million yen or less per year.

The Nomination & Remuneration Advisory Committee with independent Outside Directors comprising the majority of its members shall deliberate matters relating to the remuneration of the Directors in response to inquiries from the Board of Directors. The committee shall make a report on this to the Board of Directors. The Board of Directors shall then determine those matters with a resolution. This is to ensure the validity of those matters and transparency in the determination process.

The remuneration of Directors shall function sufficiently as an incentive to sustainably improve corporate value and to share value with shareholders toward the realization of the KAYAKU spirit that serves as our corporate vision.

At the same time, it shall be a remuneration structure at a competitive level from the perspective of securing excellent personnel. Specifically, the remuneration of Directors involved in executing business activities shall consist of basic remuneration and incentive remuneration (performance-linked bonuses and stock remuneration). The remuneration of Outside Directors with a standpoint independent from business execution shall be limited to basic remuneration.

The amount of the basic remuneration of Directors involved in executing business activities shall be determined according to the total amount of the standard amount for each objective element such as whether they have the right to representation and their duties. This shall be paid as monetary remuneration on a monthly basis.

The performance-linked bonuses of individual Directors involved in executing business activities shall be based on the degree of achievement of the targets for consolidated operating income and return on equity (ROE) set at the start of the fiscal year.

These bonuses shall then be calculated taking into account the business results of the departments they are responsible for and the degree of achievement of mid-to long-term key issue targets. The bonuses shall be paid in cash at a certain time after the end of every fiscal year. The President may determine the amount of performance-linked bonuses for individuals within the range of the amount limit of the resolution at the General Meeting of Shareholders upon being delegated with this task by the Board of Directors.Directors involved in executing business activities shall be awarded transfer restricted stock with a certain transfer restriction period at a certain time every year. This shall be done to motivate those Directors to contribute to improving mid-to long-term corporate value and shareholder value under the aim of sharing value with shareholders. The monetary remuneration credits equivalent to the stock remuneration to be awarded and the number of shares to be awarded shall be determined based on position, responsibilities, stock price and other factors.

The ratio of remuneration by type for Directors involved in executing business shall roughly be 60% for basic remuneration and 40% for incentive remuneration. This shall be determined based on position, responsibilities and other factors.

The remuneration of Audit & Supervisory Board Members shall be limited to basic remuneration in view of their responsibility to monitor the execution of the duties of Directors. The amount of remuneration for individual Audit & Supervisory Board Members shall be determined through discussions with those members within the range of the total amount of remuneration approved at the General Meeting of Shareholders.

6. Internal Control System

Nippon Kayaku is enacting basic policies in the Board of Directors to establish an “internal control system that will ensure the appropriate operations.” In accordance with these policies, we are putting systems in place, including the establishment of internal rules and necessary organizations.

Schematic of the Internal Control System

7. Compliance

The Nippon Kayaku Group views compliance as a vitally important corporate issue, and has outlined the Nippon Kayaku Group Charter of Conduct and Code of Conduct based on the contents of the ISO26000 standard (guidance on social responsibility for organizations). Compliance was also raised as one of the most important materialities to be addressed in the fiscal year ended March 31, 2019. The Group will implement the fair management of business activities by ensuring the exhaustive application of compliance–the basic principle for the practicing of business activities–and preventing compliance violations before they occur through the holding of employee training and other such measures. Further, we will also look to establishing a basic policy on the prevention of corruption by the fiscal year ending March 31, 2022, while continuing to maintain and enhance a positive corporate culture with a high sense of ethics that openly encourages communication.

[Important Themes] Ensuring Compliance

Nippon Kayaku Group Charter of Conduct and Code of Conduct

Nippon Kayaku enacted the “Charter of Conduct and Code of Conduct” in April 2000 and we have striven to be better corporate citizens based on the practical norms of society. The “Nippon Kayaku Group Charter of Conduct and Code of Conduct” were renewed in 2011 as “Roadmap” of the global group-based initiative for realizing the KAYAKU spirit, and we have made everyone in the entire group aware of these.

All officers and employees in the Nippon Kayaku Group take personal responsibility for respecting the “Nippon Kayaku Group Charter of Conduct and Code of Conduct,” and use these as “Roadmap” on conduct to realize the KAYAKU spirit, foster an even more ethical and open corporate culture and organizational climate than at present, and strive for sound, high quality management.

Nippon Kayaku Group Charter of Conduct and Code of Conduct(Corporate Vision)

8. Risk Management

Nippon Kayaku has established the Crisis Management Committee to establish a crisis management system and respond to crises and formulate plans to prevent recurrence. Crisis Management Committee Rules, a Crisis Management Manual, a BCP Manual, and other documentation have been created, and we engage in comprehensive risk management to avoid the occurrence of risks, and to mitigate loss as much as possible when they arise.

We established the Risk Management Department in the Internal Control Management Division. It operates the Risk Management Committee, ascertains company-wide risks that require crisis management, establishes departments responsible for each risk, and takes other steps to prevent and avoid individual risks from occurring. The Company also conducts regular education and training on risk management. This includes risk management education for all employees in the Nippon Kayaku Group, and annual BCP simulation drills in which the company president and all officers participate. The Audit Division also performs audits of risk management.

[Important Issues] Risk Management(Sustainability)

9. Ensure the Reliability of Financial Reporting

We established the J-Sox Department in the Internal Control Management Division as the department in charge of establishing a system to ensure the reliability of Nippon Kayaku’s financial reporting and evaluate the operation of that system. We also regularly evaluate the management and operation of our system to ensure the reliability of our financial reporting. The results of these evaluations are reported to Representative Directors.

10. Basic Concept of Information Disclosure

Nippon Kayaku discloses information to shareholders, investors, and all other stakeholders in a timely and fair manner to earn the trust of all our stakeholders and to continue to be a company that is needed by society.

The Company established the Disclosure Committee, and sets forth the Disclosure Policy and strives for fair and impartial disclosure of information through the Timely Disclosure Network (TDnet), the corporate website, and media organizations.

Communication with Shareholders and Investors

Nippon Kayaku promotes constructive dialog with shareholders and investors. We are aiming to achieve sustainable growth and increase the Company’s corporate value over the mid- to long-term by doing so. Based on this thought process, we have appointed an officer in charge of IR as the chief person responsible for all dialog with shareholders and investors. The Corporate Communications Division, which is the division in charge, communicates with the relevant internal divisions, and works to engage in dialog with shareholders and investors by holding regular briefings on financial results and other means.

We also work diligently to manage information so that it is not provided only to some people when engaging in dialog with shareholders and investors, and report the opinions and comments gleaned from such dialog to executive management on a regular basis.